Will The Rising Cable Copper Price Turn International Speculators Into Lambs To The Slaughter?

Jul 23,2024

Jul 23,2024

Suke

Suke

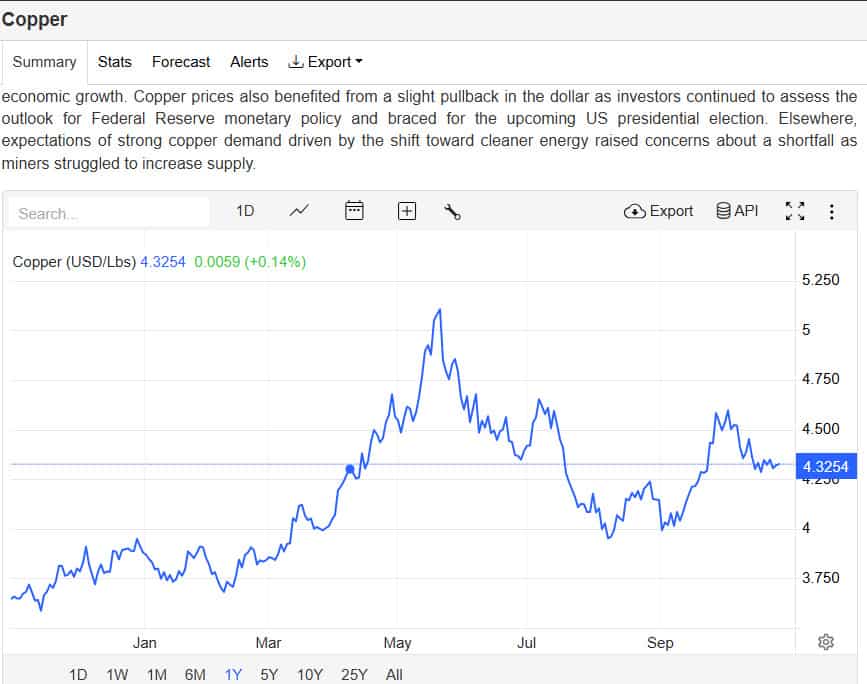

Cable copper prices fell the most in a single week since 2022, yet global copper stocks remain high, which seems to be unfavorable to Chinese copper demand. On top of that, copper futures on the London Metal Exchange (LME) fell more than 5% this week, while aluminum, tin , and nickel prices also fell sharply.

By now, LME cable copper price closed down 0.86 percent at $9,287, the fifth consecutive session of losses. Importantly, the short-line pattern is very unfavorable as it failed to hold the key 120-day SMA support on Thursday, while Friday's losses extended further. Cable copper price hit an all-time high of $5.20 per pound in May, up 25 percent year-on-year. This was the first time in two years that international copper prices exceeded the $10,000 per tonne mark. After this, however, cable copper price retreated, showing a steady downward trend. Cable copper prices rose in the case of China's market demand was not high, and coupled with sufficient inventory, the purchase did not reach a new high. Supply exceeded demand, but exacerbated the rate of decline in cable copper price.

Not only China but also global copper stocks remain high. Inventories at the LME's main delivery depots have more than doubled since mid-May to the highest level since September 2021, with most of the stock injections coming from Asia -- mainly China. Friday's data showed that 0.4 million tonnes of copper were being shipped to LME warehouses in Asia. Daniel Hynes, a commodity analyst of ANZ Bank, said that conferences in China didn't introduce any stimulus measures, dampening market sentiment. It's disappointing for investors that the government hasn't focused more on solving structural problems in the economy, such as the struggling property sector.

The rising of cable copper price started in March and in quickly escalated into a short squeeze in early May. It is believed to have been orchestrated by a group of top international speculators following the logic of the copper concentrate shortage. The problem now is that actual market demand is weak and downstream simply cannot afford to pay more than $8,000 per tonne of copper. According to the style of these main speculators, the conditions of the low cost of holding positions, they should not have quit buying and selling copper transactions. However, following speculators, especially leveraged speculators, have been gradually blowing up their positions as the downtrend develops, and this group of speculators will be gradually harvested as prices move towards the 200-day SMA.

Home

Home Why Does The Underwater Power Cable Cost So Much?

Why Does The Underwater Power Cable Cost So Much?  You May Also Like

You May Also Like

Tel

Tel

Email

Email

Address

Address